Why Your Content Gets Seen But Not Clicked: The Real Story Behind Clicks vs Impressions

In May 2025, BrightEdge published findings that underscore a pivotal development in digital marketing: although Google search impressions grew by 49%...

%20(23).png?width=302&height=302&name=_SD%20web%20assets%202025%20(500%20x%20500%20px)%20(23).png)

3 min read

Marketing

:

Updated on April 8, 2025

The digital marketing landscape is abuzz with talk about Google potentially losing its grip on the search advertising market. Recent reports, including a noteworthy article from the Wall Street Journal and exclusive data from Sara Lebow at Skai, have claimed that Google might fall below 50% of the U.S. search advertising market share in 2025. This would mark the first time since 2008 that Google holds less than half of the market.

In this article, we’ll dig deeper into the data, explore the factors driving these changes, and explain what they really mean for businesses investing in digital marketing.

The Wall Street Journal points to the growing influence of platforms like TikTok and AI-driven search engines such as Perplexity as major threats to Google’s search advertising dominance. However, our analysis at SmithDigital suggests that these concerns may be overblown. Data from our partners and other industry insights indicate that while platforms like Perplexity and TikTok are growing, they have not yet reached the scale needed to significantly impact Google's market share.

Industry experts point out that despite the hype around AI search engines, 83% of users still primarily rely on traditional search engines like Google. Even among those experimenting with AI-driven searches, 99% continue to use Google as well. The numbers simply don’t add up to suggest an immediate threat to Google’s dominance.

Interestingly, much of the growth in the search advertising space is coming from retail media platforms like Amazon, Walmart, and Instacart rather than from AI search engines or social media. According to data from eMarketer, Amazon’s U.S. search ad revenues are growing 17.6% this year, compared to Google’s 7.6%. While Google’s absolute dollar growth remains higher, Amazon's faster percentage growth means it’s steadily gaining ground.

This trend toward retail media advertising aligns with the growing consumer habit of starting their product searches directly on e-commerce platforms rather than on traditional search engines. For digital marketers, this shift emphasizes the importance of diversifying ad spend to include platforms beyond Google.

From Lebow’s insights, we can identify four major trends that are shaping the future of paid search advertising:

Paid Search Ad Spend vs. Impressions

User Hesitancy to Click Ads

Google’s Dominance in Global Search Volume

The Cost Dynamics of Retail Media Advertising

For businesses and marketers, the takeaway is clear: Google is still the leading force in search advertising, but the landscape is evolving. The rise of retail media, coupled with changes in user behavior due to AI integration and social media, suggests that diversifying ad strategies is more important than ever.

At SmithDigital, we believe that this shift presents an opportunity for firms to rethink their digital marketing approaches. By leveraging data-driven insights and focusing on platforms that show high purchase intent, businesses can make their ad spend more effective, reaching the right audience at the right time.

The reports of Google losing its search advertising market share may be accurate to an extent, but they also miss the broader context. While Google's share might dip below 50%, it is not due to the sudden dominance of AI search engines or TikTok, but rather the steady rise of retail media platforms like Amazon and Walmart.

For marketers, this means staying agile and continuously testing new platforms while keeping a strong foothold on Google. By combining a deep understanding of search behavior with targeted advertising strategies, companies can maximize their reach and conversion rates in this dynamic digital landscape.

SmithDigital remains at the forefront of these changes, guiding software, tech, and professional service firms through the evolving world of digital marketing and lead generation. As the market continues to shift, we’ll be here to help you navigate these complexities and achieve the best results for your business.

In May 2025, BrightEdge published findings that underscore a pivotal development in digital marketing: although Google search impressions grew by 49%...

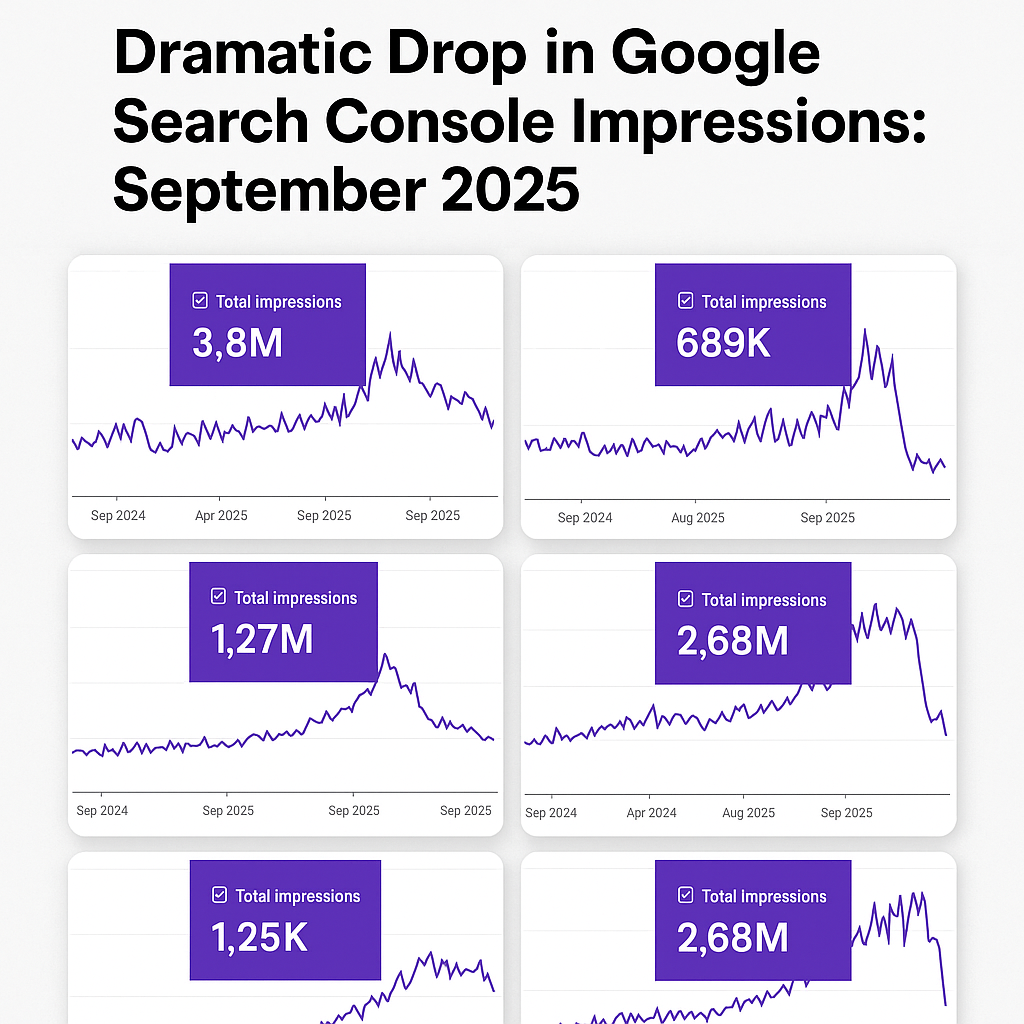

Starting around September 10–15, 2025, many SEOs and webmasters began noticing a significant decline in Google Search Console (GSC) impressions. For...

.png)

Maximizing your brand’s visibility in AI-driven search results is no longer optional—it's essential. As AI technology increasingly influences how...